How Elder Law Planning Protects Families

Elder law is not only about preparing documents. It is about creating a framework that protects your care, dignity, and financial stability as you age. Without that framework, families are often left scrambling in moments of crisis:

- A hospitalization without a health care proxy can leave doctors making critical decisions without your input, or force family members to go to court just to be heard.

- A spouse or child without power of attorney may be powerless to access bank accounts, pay bills, or coordinate care while expenses mount.

- Well-meaning relatives may disagree about “what Mom would have wanted,” leaving families divided at the very moment they should be united.

- The absence of clear planning may even lead to guardianship proceedings, which can be costly, and emotionally painful for everyone involved.

A thoughtful elder law plan prevents these outcomes by:

- Empowering trusted decision-makers. Properly drafted powers of attorney and health care proxies keep authority with people you choose, not strangers or courts.

- Protecting family relationships. By putting wishes in writing, you reduce the risk of conflict or guilt among loved ones who might otherwise be forced to make impossible decisions.

- Preserving stability. With clear instructions in place, spouses and children can focus on care and support instead of navigating red tape.

- Ensuring continuity of care. Early planning allows families to anticipate long-term needs, such as home health aides, assisted living, or nursing care, and balance those costs without jeopardizing financial security.

These conversations are not easy, but they are essential. And they are far less stressful when they happen early, with professional guidance and clear explanations of every option.

At Esther Schwartz Zelmanovitz, PLLC, we believe the way you are treated is as important as the plan itself. We approach each client’s situation with patience and compassion, explaining your options in plain language so you feel informed, supported, and prepared. Our goal is to give you peace of mind that your family is protected and your wishes will be honored—no matter what the future holds.

Our Boutique Approach

Since 2017, our boutique practice has focused exclusively on elder law, estate planning, and probate for clients across Long Island and the five boroughs. We are not a volume-driven firm where files move in and out with little personal attention. When you work with us, you work directly with attorneys who know your file, understand your family, and remain available when questions arise down the road.

Families choose us not only for legal knowledge, but because of how we work:

- Patient, Compassionate Guidance. Elder law often touches on sensitive issues—declining health, financial strain, or family disagreements. We take the time to listen, explain your options carefully, and move at a pace that feels right for you.

- Responsive Communication. We make it a priority to return calls, answer questions, and keep you informed. Clients never feel left in the dark, especially during stressful moments.

- Integrity and Practicality. We recommend only what is truly necessary for your situation, and we draft with precision so your plan works in the real world, not just on paper.

- Tailored Solutions. No two families are alike. We learn your goals, values, and concerns, then design strategies that fit your life—not a one-size-fits-all template.

Our founder, Esther Schwartz Zelmanovitz, has more than 23 years of experience, over 10 of which has been guiding families through elder law and estate planning. Clients frequently remark not only on her professional skill, but on her ability to make complicated issues clear and manageable. That combination—legal acumen with genuine care—is the hallmark of our practice and why so many clients return to us as their needs evolve.

What Is Elder Law?

Elder law is the advice and education delivered to a paying client about legal devices and techniques that apply to elderly people, their families, and their caregivers. It is a more specialized area of estate planning and involves advice around wills and trusts, powers of attorney, qualification for state Medicaid services, and preservation of assets if Medicaid is needed. Additionally, elder law attorneys frequently advise clients about Social Security income, Social Security Disability resources, and planning for in-home caregivers or admission to nursing home facilities.

A good elder law attorney will have experience advising clients in the above areas and will be familiar with local and state law, which can be very specific and different from the laws of other states. For example, New York State Medicaid rules are quite different from Medicaid in Florida. If you or your family may be employing in-home caregivers, then some familiarity with employment law will also be required. Additionally, there are techniques in gifting and transferring assets to family members or to irrevocable trusts that can help protect family assets for the next generation.

Personalized Planning and Protective Documents

We work closely with our clients to prepare for unexpected health events or incapacity, developing contingency plans to ensure your wishes are honored and loved ones are empowered to step in when needed. This often includes drafting instruments such as living wills, health care proxies, and HIPAA releases—essential for residents of Nassau or Suffolk counties. Every situation is unique, so our elder law attorneys in Long Island employ a personalized approach to address your priorities proactively and compassionately.

A skilled elder law attorney will have ongoing experience advising clients in these areas and will be knowledgeable of New York and local laws, which can be highly specific and often differ dramatically from statutes in other states. For example, Medicaid rules in New York are distinct from those in Florida, affecting both eligibility and planning options. Families employing in-home caregivers must also consider local employment law requirements. Additionally, gifting and asset transfer strategies—such as establishing irrevocable trusts—can effectively preserve family wealth for generations when properly designed under New York regulations.

- Recommended reading: NYS Income and Resource Limits for Medicaid (2025)

Our Values, Your Peace of Mind The Principles That Define Our Firm

-

Compassionate, Relationship-Driven Service

We believe every client deserves to be treated with dignity, patience, and genuine care. Our firm fosters long-term relationships, guiding families with warmth and empathy through emotionally sensitive matters like elder care, estate planning, and loss.

-

Clear, Respectful Communication

We prioritize honest, prompt, and respectful communication. Whether answering questions or guiding you through complex decisions, we're responsive, dependable, and committed to making the process as smooth and stress-free as possible.

-

Serving with Integrity and Excellence

We hold ourselves to the highest standards of ethical practice and professional excellence. Clients can count on us not just for our legal knowledge, skill and experience, but for honesty, transparency, and unwavering advocacy on their behalf.

-

Tailored Legal Guidance for Every Client

No two clients are the same. We take the time to truly understand each client’s concerns, goals, and values, crafting customized legal solutions that reflect what matters most to them.

How Do I Choose the Best Elder Law Attorney for My Situation?

You’ll want to find an attorney who is knowledgeable, experienced, and has a good bedside manner. The attorney should be continually learning their trade and participating with their peers to establish best practices for their practice area and region.

Fortunately, there are practical ways to identify a reputable elder law lawyer in Long Island. For general legal reputation, an attorney’s rating can indicate positive results from past clients; you can find these on Avvo, Google, and other trusted sources. Additionally, the state bar maintains any incident of professional discipline, and this will let you know of any serious problems that the attorney has been involved in.

Understanding Medicaid Planning

Medicaid planning is a concern for many seniors and their families in Long Island, given New York’s unique eligibility requirements and the high cost of elder care. Unlike private insurance, Medicaid offers substantial support for long-term nursing home care, assisted living, and services like home health care—but only for those who meet strict income and asset criteria. The Medicaid program in New York also enforces a look-back period, during which asset transfers are carefully reviewed; improper transfers can result in penalties or periods of ineligibility for benefits.

In Nassau and Suffolk counties, understanding how Medicaid planning works means more than knowing statewide requirements—it also requires familiarity with county Medicaid offices, local application procedures, and specific regional nuances. At Esther Schwartz Zelmanovitz, PLLC, our elder law attorneys in Long Island advise families on the timing and strategy of asset transfers, home protection, and Medicaid eligibility documentation. We educate clients on state programs that support New York residents, such as the pooled income trust for those with excess income, and help you leverage local waiver programs for community-based care. Working with our team—thoroughly familiar with Long Island Medicaid processes—means you can approach Medicaid planning with confidence and strong local support.

The Cost of Assisted Living or Nursing Home Care

No one ever wants to think about the possibility of having to live in a nursing home or an assisted living facility, yet more than half (52 percent) of those turning 65 will need some level of long-term care services during their lifetime. High-net-worth people will likely self-fund the costs of long-term care, while those without significant financial assets will rely on Medicaid to provide long-term care. In between these two groups are those with some financial assets, but likely not enough to fund long-term care outlay at the end of their lives. This group could find their available long-term care choices limited—and rather unappealing. Traditional, long-term care insurance could be purchased, although premium hikes are likely as we age.

This is likely due to better health care among the more affluent, as well as better nutrition. According to the New York Department of Health, the annual estimated average nursing home rate in 2023 was $169,632 on Long Island and $169,704 in New York City. Home health care in the state of New York is also expensive, with the average cost in 2011 at $20 per hour; today, the costs are even greater.

Navigating Guardianship and Conservatorship in Long Island

When a loved one becomes unable to make financial or healthcare decisions, New York’s guardianship process provides a framework to ensure their needs are met with dignity and care. On Long Island, guardianship cases are managed in Nassau or Suffolk County Surrogate's Courts under Article 81 or Article 17-A of the Mental Hygiene Law. The guardianship process involves petitioning the court, presenting clear medical and financial evidence, and ensuring that all interested parties are informed. While these steps protect the individual, they can present both procedural and emotional challenges for families navigating the system.

Our elder law lawyers in Long Island support clients at every stage of the guardianship process, from document preparation and evidence gathering to representation at court hearings. We provide in-depth guidance on the type of guardianship to pursue—whether full or limited authority—to suit your circumstances while complying with New York’s laws. Our familiarity with Long Island courts means our clients benefit from knowledgeable, detailed direction and genuine compassion, which has always set Esther Schwartz Zelmanovitz, PLLC apart.

The Many Ways Planning Can Make a Difference in Your Future

It is important to note that these numbers are not nearly as frightening when you have made solid plans for your golden years! There are a number of ways that allow you to protect your assets in the best way possible. There are also additional ways to pay for nursing homes, assisted living, and home care.

When you have an experienced New York elder law attorney by your side, he or she can help you determine the extent to which government programs, such as Medicaid, may be able to defray the costs associated with your future care. You may also be able to place your assets where they are protected, which can help you set up alternative plans to pay for your future care.

Should your health deteriorate to the point that you are incapable of managing your affairs—financial, legal, or business—you will also take comfort in having a plan in place which allocates that responsibility to a person of your choice—someone you trust. An Elder Law attorney can help you prepare a Power of Attorney that will authorize a person of your choice to assist you with legal and financial matters when you have difficulty managing your affairs.

A Power of Attorney prepared by an Elder Law attorney will include additional specific provisions that will enable the person of your choice to proceed with planning that will preserve your assets while accessing benefits to cover your long-term care needs. Finally, your Elder Law attorney can assist you with the entire estate planning process, and assist you with a will, a trust, or a health care directive, a Power of Attorney, and additional documents that may be needed in your plan.

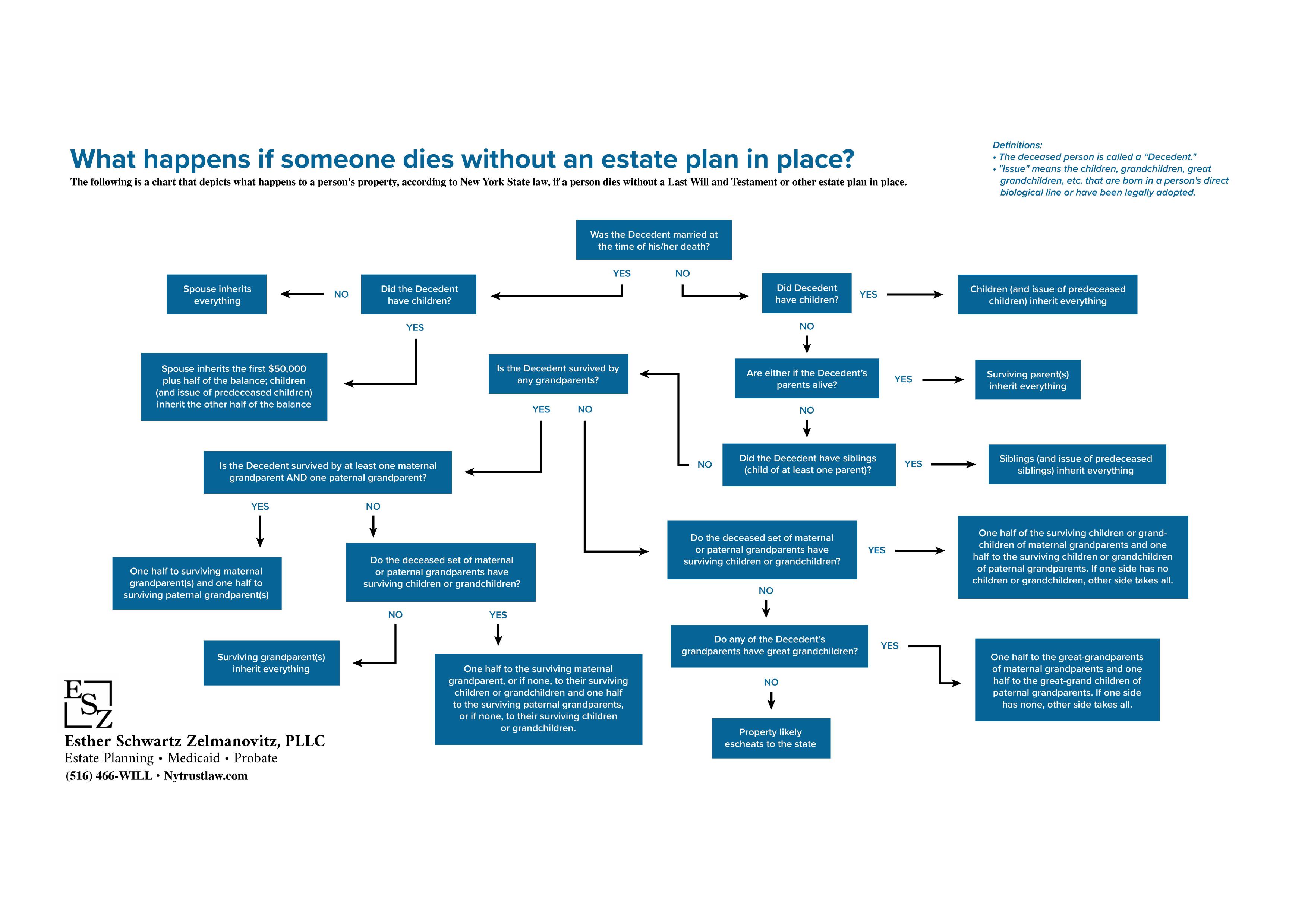

What happens if someone dies without an estate plan in place?

CLICK TO DOWNLOAD THE FULL CHART

For trusted legal guidance, reach out to a knowledgeable elder law lawyer in Long Island. Call (516) 347-7356 or contact us immediately to schedule your consultation.