Estate Planning For All Ages

TV and movies don’t show the truth. Hollywood makes us think that you sign your Will (or a trust) only when you’re old and facing death. The truth is, it’s almost never like that, and in fact, there are really important reasons to think about and execute (or update) your estate planning at all stages of your life. Below we will discuss many various stages or situations of life that may deserve different levels of attention to your estate planning.

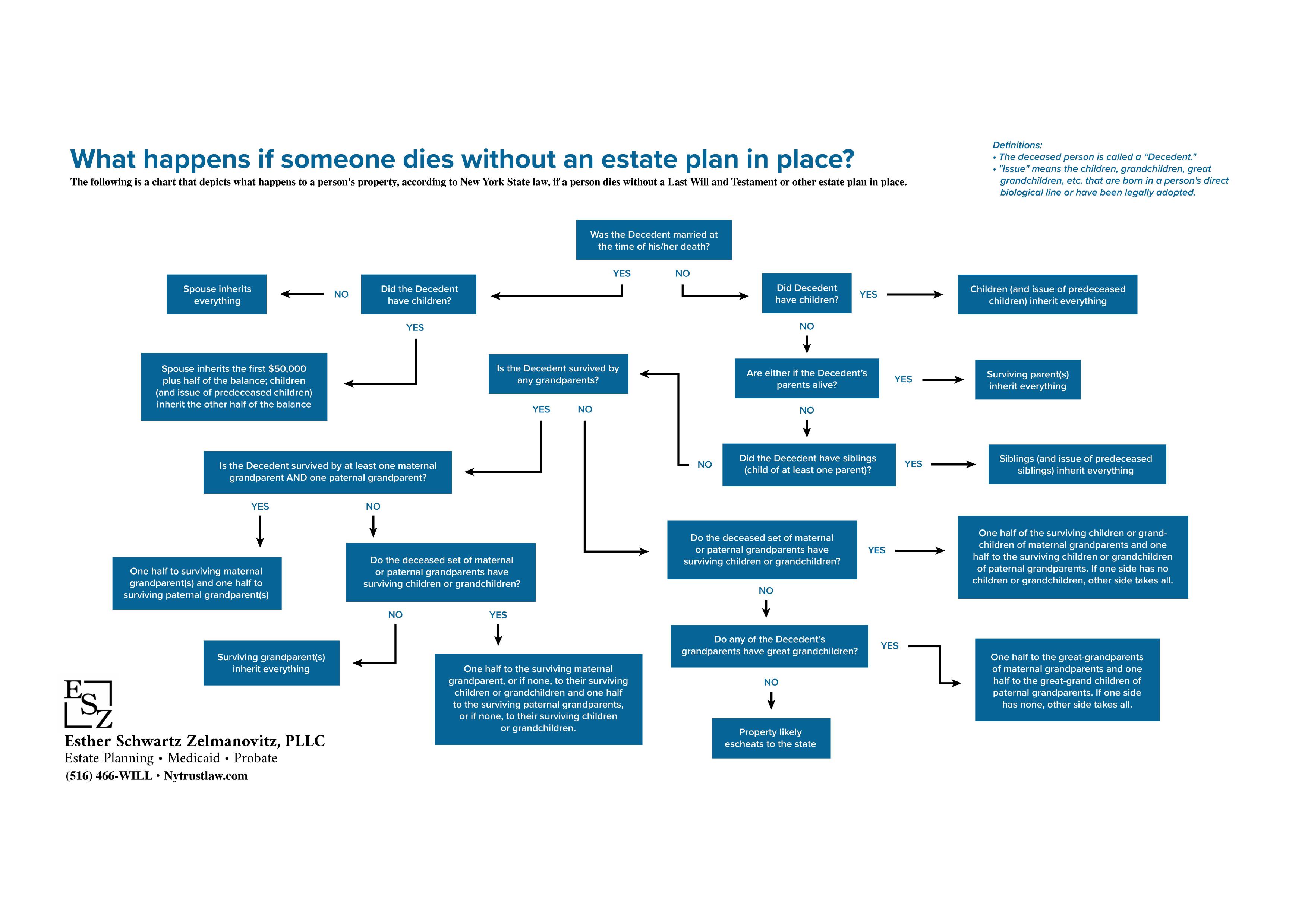

What Happens If Someone Dies Without an Estate Plan in Place?

Single Young Adult

If you’re a young bird fleeing the nest towards college or an early career, your parents should be reminded that once their child becomes an adult, the rights parents have to discuss their child’s medical choices or handle financial affairs cease at 18. For a young adult, they may not have much of an estate, but it’s important to have the basic documents in place, such as a simple will granting their estate to their parents or siblings.

Probably the biggest priority is for parents to have access to validly executed Health Care Proxy and Financial Power of Attorney documents for a young adult child. These are important in the event of illness or incapacity so that the parent can handle the affairs of the adult offspring. Few young people are going to be thinking that these estate planning documents are an important priority worthy of their limited budget – therefore this may be a parent-sponsored phase where the parent offers to pay for or make arrangements for the young adult to sign these important planning documents.

New Relationship But Not Married

For those that are deciding to commit to another person, but maybe are not taking the step to become legally married, many of the same “newlywed” points apply. But many attorneys will argue that it becomes even more important for a couple in this category to execute the estate planning documents discussed so far, since a non-married partner is not granted many of the state-law and federal benefits of a married spouse. Examples of this include HIPAA access, marital/homestead shares of an estate under state law, and presumed rights of survivorship for real estate and other assets. A non-married partner will not be recognized for providing input on healthcare decisions unless a Healthcare Proxy is in place. Additional concerns relate to financial issues, such as bank accounts, retirement accounts, utility services – a non-married partner may need to discuss or access these but wouldn’t be able to without a durable power of attorney. Furthermore, a non-married partner will not have certain inheritance rights that a married person would have. A will or trust will help ensure that upon one partner’s death, the other receives intended assets as an inheritance, without family or government intervening to change the outcome.

New Parents

Our Values, Your Peace of Mind The Principles That Define Our Firm

-

Compassionate, Relationship-Driven Service

We believe every client deserves to be treated with dignity, patience, and genuine care. Our firm fosters long-term relationships, guiding families with warmth and empathy through emotionally sensitive matters like elder care, estate planning, and loss.

-

Clear, Respectful Communication

We prioritize honest, prompt, and respectful communication. Whether answering questions or guiding you through complex decisions, we're responsive, dependable, and committed to making the process as smooth and stress-free as possible.

-

Serving with Integrity and Excellence

We hold ourselves to the highest standards of ethical practice and professional excellence. Clients can count on us not just for our legal knowledge, skill and experience, but for honesty, transparency, and unwavering advocacy on their behalf.

-

Tailored Legal Guidance for Every Client

No two clients are the same. We take the time to truly understand each client’s concerns, goals, and values, crafting customized legal solutions that reflect what matters most to them.

Parents of Teenagers

It may feel like it’s only been a few years since the plan was updated or first established, but it’s worth taking another look as the child hits mid-teen years. They’ll be driving soon, dating, and beginning to frame their decisions toward college. This is a great time to revisit the guardian decision for a minor child. Is the nominated guardian still a proper choice to manage a teenager? Has the guardian moved, or how’s their age and ability? Is there an adult sibling that could serve as guardian instead? Contemplate a backup guardian in the event the first nominated party cannot serve. Has your child been diagnosed with any special needs that should be addressed in your estate plan?

Parents of Young Adults

So, it may have been only a few years since the last review and revision, but there are new concerns to be addressed as a child becomes an adult. As children move out of the house and look towards college and careers, they are also potentially seeking a spouse or partner to share their life. This can be a good time to reevaluate the terms of the parent’s trust and will. Legal guardian nominations are no longer needed, but perhaps the terms of the trust for the young adult need some adjustments for this phase of their life?

One concern many parents have, is how to protect a child’s inheritance from a spouse or partner. Some trust planning can help minimize or eliminate this concern. It is well-settled law in most jurisdictions that inheritance is the sole and separate property of the person who receives it. However, when an inheritance passes outright to a beneficiary, he or she has the freedom to commingle those funds with a spouse or partner, and this can tarnish the identity of those assets as separate property. Trust planning can instead insist that the parent’s trust remain in place to manage and hold those inherited assets as separate property of the beneficiary.

Some family education and discussion about inheritance can be very helpful. Sitting the child(ren) down to discuss the parents’ legacy and specifically their expectations of preserving inheritance as separate property is invaluable family time. It can be especially important for the child to know about these expectations, including their parents’ expectations regarding prenuptial agreements relating to any use of gift or inheritance before they fall in love with that special person – that way it’s not sprung on the child as a surprise and the result of the new relationship. It helps neutralize the emotions of this idea. For the child to know about this requirement before falling in love prevents the child feeling that the parent is disapproving of the child’s selected partner.

Parents may also want to revisit their Healthcare Proxy and Durable Power of Attorney documents. Perhaps the young adult child can serve in some capacity if the parent feels that the child can handle that responsibility.