Table of Contents

1) Power of Attorney and Health Care Directives Lawyer in Long Island

2) What is a Durable Power of Attorney?

3) Is There a Difference Between a Power of Attorney and a Durable Power of Attorney?

4) Do I Need a Lawyer to Create a Power of Attorney in NY?

4.1) Is the power of attorney that I downloaded from the internet good?

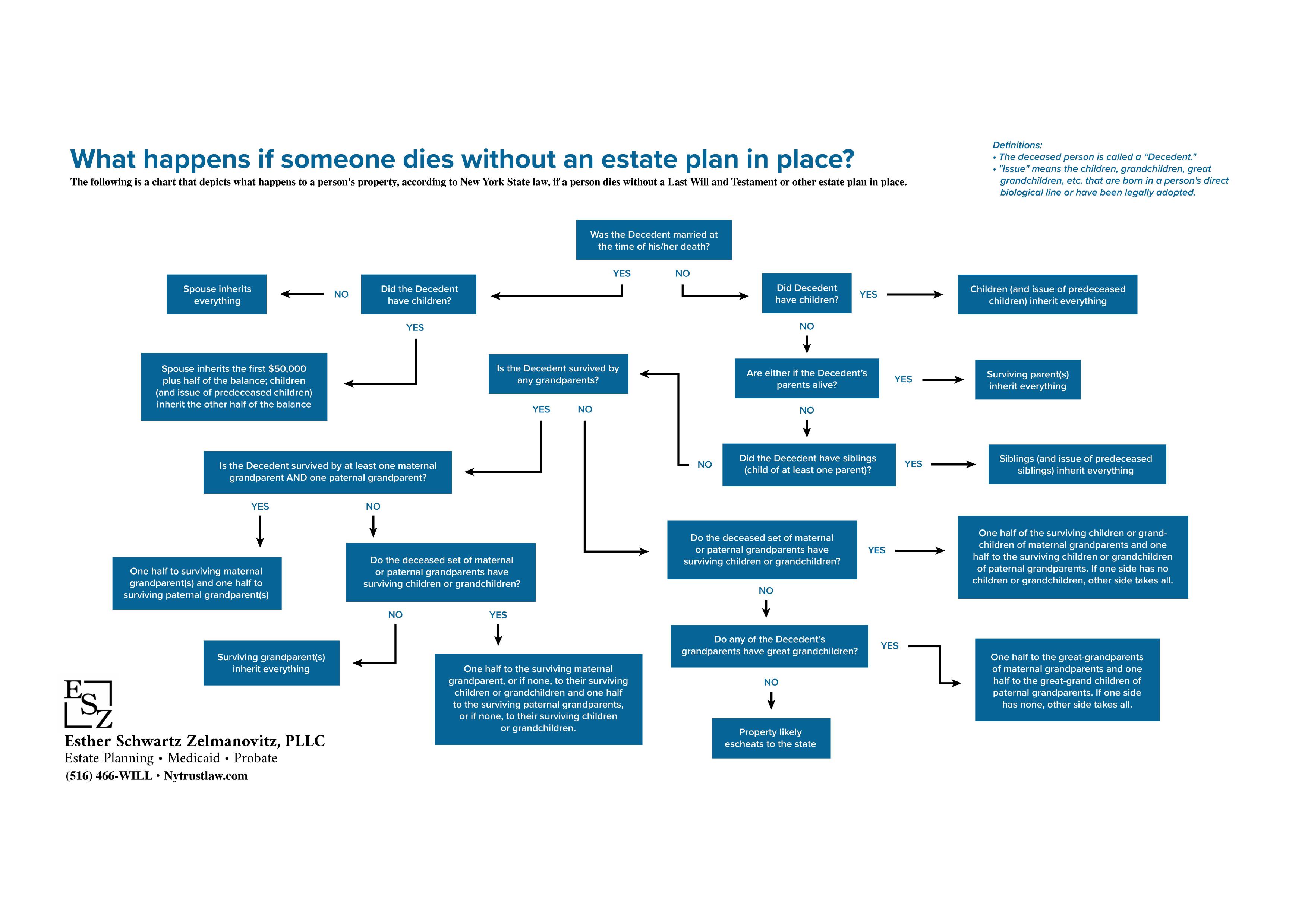

4.3) What happens if someone dies without an estate plan in place?

5) Health Care Directives in New York

6) We Can Help You Prepare a Durable Power of Attorney and Health Care Directives

Long Island Power of Attorney and Health Care Directives Lawyer

When most people think of estate planning, they think it addresses only after death issues. But the most important estate planning documents may actually be the documents you prepare to be used during your lifetime, in the event of incapacity. We all hope to live long, healthy, and peaceful lives, but in the face of unexpected tragedy or the onset of dementia, it is critical to have specific estate planning documents in place to ensure that your wishes are followed and you have legally authorized the people of your choice to make crucial decisions in the event you cannot.

Our lawyers work with clients throughout Long Island and beyond on power of attorney, healthcare directives, healthcare proxies, living wills, and more.

Call (516) 347-7356 or contact us online today to schedule a free, initial 15-minute phone consultation.

What Is a Durable Power of Attorney?

A Durable Power of Attorney prepared by an experienced elder law attorney is the most important document you can have as part of your estate planning. A properly executed Durable Power of Attorney is crucial to allow a person you have chosen and trust to handle your finances. It’s the legal protection that exists just in case you become unable to make your own financial decisions due to a medical condition, illness, or incapacitation.

Wouldn’t next of kin automatically step in if there was no power of attorney?

What is the default procedure?

Contrary to what some may believe, there is no default person with the ability to act as an agent for legal and financial matters on behalf of someone else. If you have lost mental capacity and needed something legal or financial performed on your behalf (from simply paying bills to more involved, such as signing a nursing home admissions agreement or setting up or modifying a trust, etc.), under New York State law NO ONE would automatically have authority.

A spouse, parent, child, or sibling wouldn’t automatically have the authority to act for an incapacitated individual. The only direct way a person can act for another individual, legally or financially, is by an individual signing a power of attorney when they have the capacity to do so, naming the person or people of their choice to act as an agent on their behalf. If you did not sign a power of attorney and became incapacitated, someone would have to petition the court to be appointed your legal guardian. The guardianship court process can be very costly, very time-consuming, and takes an emotional toll as well.

Case Study: Bob and Mary, husband and wife, own their one-family home together. Bob is now mentally incapacitated due to Alzheimer’s Disease. He can no longer climb the steps in their home and has suffered disorientation and falls. Mary feels it would be very helpful to sell their multi-story home and downsize to a smaller one-floor apartment for Bob’s safety and well-being.

Our Values, Your Peace of Mind The Principles That Define Our Firm

-

Compassionate, Relationship-Driven Service

We believe every client deserves to be treated with dignity, patience, and genuine care. Our firm fosters long-term relationships, guiding families with warmth and empathy through emotionally sensitive matters like elder care, estate planning, and loss.

-

Clear, Respectful Communication

We prioritize honest, prompt, and respectful communication. Whether answering questions or guiding you through complex decisions, we're responsive, dependable, and committed to making the process as smooth and stress-free as possible.

-

Serving with Integrity and Excellence

We hold ourselves to the highest standards of ethical practice and professional excellence. Clients can count on us not just for our legal knowledge, skill and experience, but for honesty, transparency, and unwavering advocacy on their behalf.

-

Tailored Legal Guidance for Every Client

No two clients are the same. We take the time to truly understand each client’s concerns, goals, and values, crafting customized legal solutions that reflect what matters most to them.

Health Care Directives in New York

A Health Care Proxy is a document that allows you to designate a trusted person to make healthcare decisions on your behalf should you become unable to make those decisions yourself. The person named in a Health Care Proxy can be given broad powers to make healthcare decisions on your behalf.

To establish a Health Care Proxy, we will draft and prepare a document outlining your preferences and naming your agent for your signature before two witnesses. Your agent may be a family member, close friend, or any person you trust to respect your wishes and act in your best interests. The scope of their authority can vary depending on what you agree to in the document. Some people opt to give their agent broad powers to make decisions, while others provide specific instructions about types of care they would or would not want.

Your healthcare agent will act as your advocate when you are unable to communicate, making sure that medical professionals follow your instructions. These decisions could include approving medical treatments, managing interactions with doctors, selecting long-term care options, or, in some cases, making decisions about end-of-life care, including the termination of life support. The agent’s responsibility begins only when you are deemed unable to make your own decisions, such as after a serious accident, loss of consciousness, or advanced dementia.

The benefits of naming a Health Care Proxy include:

- Personalized care. A Health Care Proxy is there to verify that your medical care aligns with your personal values, beliefs, and preferences. It prevents generic, one-size-fits-all medical solutions.

- Avoids unnecessary family conflict. Without clear instructions, family members may disagree about what medical actions should be taken. A Health Care Proxy eliminates ambiguity by designating a decision-maker.

- Efficient decision-making. Emergencies often require quick decisions. Having a Health Care Proxy enables someone to be immediately ready and legally authorized to act, avoiding delays that can arise when medical staff must wait for consensus.

- Improved communication. Your agent becomes the central contact point for healthcare professionals. They can clarify your preferences, authorize treatments, and ask necessary questions, creating a streamlined communication process.

- Protection of autonomy. You are able to remain in control of your medical care through the trusted person you appoint.

Including a Health Care Proxy in your estate plan is about more than safeguarding medical decisions. It is about securing peace of mind for both you and your loved ones. Without this document, important decisions often fall to family members unprepared for the responsibility or escalate to court involvement, which can be time-consuming and costly.

It is important to review your Health Care Proxy periodically, ensuring the designated agent remains the right choice and updating as necessary. By creating this document today, you take a proactive step to protect your future and relieve potential burdens on those you care about most.

If you have no Health Care Proxy or other healthcare directives, such as a living will, a physician might be required to provide treatment you might have refused, had you been able. Further, in New York, the law may allow a family member that you would not have chosen, to make medical decisions for you. It is important to choose a healthcare agent you trust and who you are confident will advocate on your behalf, making sure your wishes are carried out.

While it is difficult to plan for every scenario, the more you discuss with your agent, the easier it will be for him or her to make decisions on your behalf. It is also recommended to have a HIPAA Authorization, which names those you authorize to receive your medical records. This can make navigating your health care easier.