Are you 18 years old or older?

Then Yes, You Probably Need a Will

I am still surprised by how often I encounter relatives, friends, neighbors, and acquaintances who simply don’t understand how important it is to have a will. I’m referring to smart people! Speech therapists, accountants, and teachers, to name a few. Many people have a huge misconception that they are not a candidate for estate planning and that this topic is not relevant to them.

Several estate planning documents are important for everyone to have, such as a health care proxy, durable power of attorney and last will and testament. Below I will focus on the last will and testament, otherwise referred to as a “will” and I will explain why it is important for you to have one prepared immediately.

If you have a crystal ball, or other super powers that can tell you the future, and specifically, your date of death, then you can hold off on preparing a will if that date is far off. For everyone else, while we pray for a long healthy life, we don’t know what may come tomorrow, and therefore, let’s make sure we are prepared.

What will happen if I do nothing and don’t have a will?

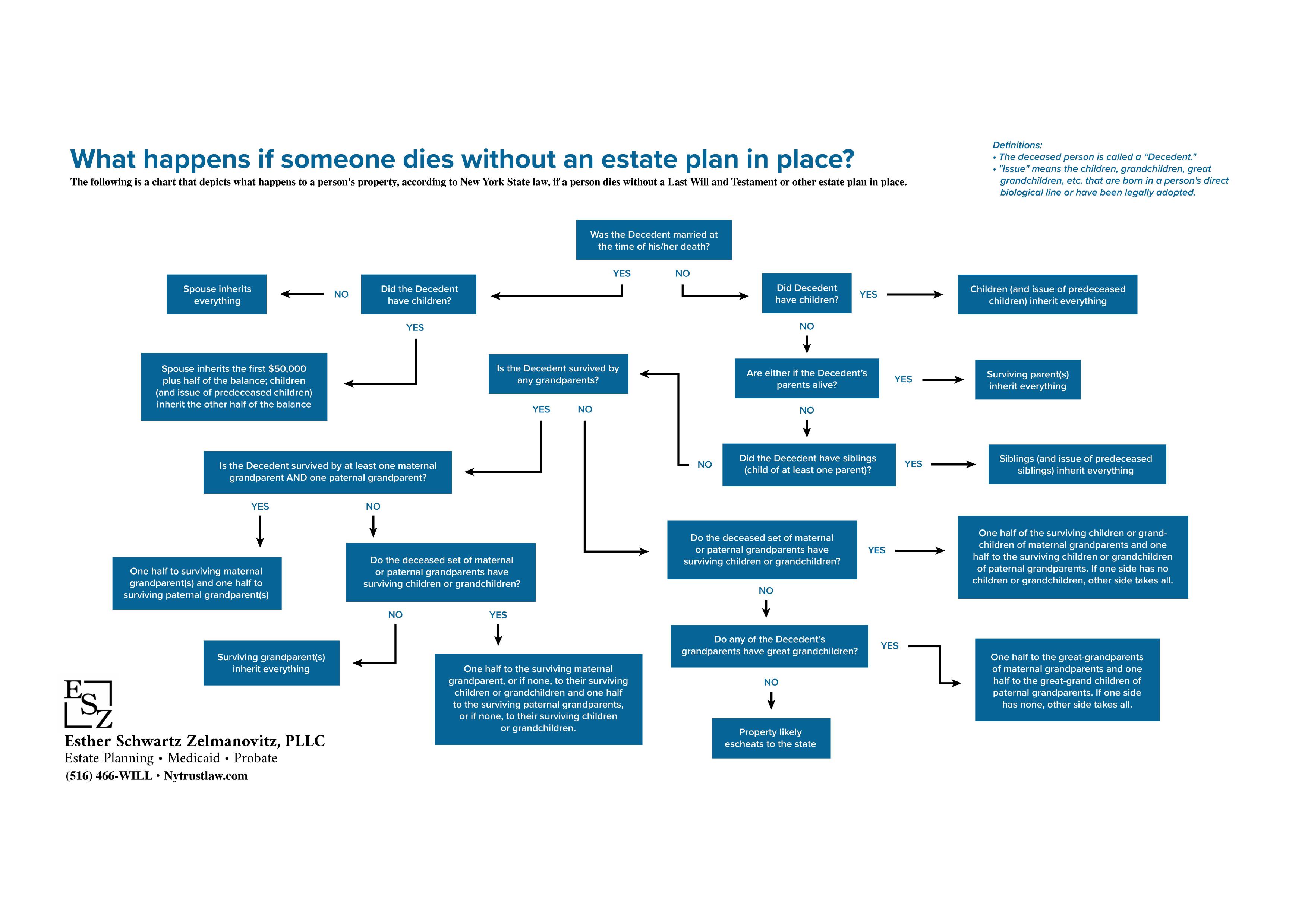

If you are a resident in New York State, and you die without having a will, New York State laws will govern who gets your assets (the money and things that you own). Sometimes, it is automatic, such as in the following situations:

- If you own an account or property together with someone else, it is possible that you own it together as “joint tenants,” which means that after one owner dies, the surviving owner becomes the owner of the full account or property automatically.

- If you name a beneficiary on an account, life insurance, or annuity, the named beneficiary will inherit that asset without court involvement.

- If your asset is held in a trust, the trust will govern who gets the asset after you pass away, without the need for court involvement.

However, if something is owned by you in your name alone, with no joint tenant, no named beneficiary, and not in trust, New York State will decide who gets your assets if you don’t have a will in place.

After administration expenses, taxes, and debts are paid, the state requires that distributions are to be made as follows:

Probate vs. Estate Administration

When there is a will, the process to obtain access to a deceased person’s assets and distribute it to those that inherit is called “probate”. Without a will, the process is called “administration.”

A Will Lets You Choose Who Will Be in Charge of Your Estate After You Die

A will can designate the specific person that you choose to be your estate’s “executor,” the person in charge of taking care of everything as per your instructions in the will. This is likely someone that you trust and who will honor and respect your specific requests and wishes. On the other hand, during an administration proceeding, the court will appoint the “administrator” who will be in charge. There is an order of preference for close relatives, but it is possible that it could end up being the Public Administrator, whereupon your loved ones will lose control of the process.

Our Values, Your Peace of Mind The Principles That Define Our Firm

-

Compassionate, Relationship-Driven Service

We believe every client deserves to be treated with dignity, patience, and genuine care. Our firm fosters long-term relationships, guiding families with warmth and empathy through emotionally sensitive matters like elder care, estate planning, and loss.

-

Clear, Respectful Communication

We prioritize honest, prompt, and respectful communication. Whether answering questions or guiding you through complex decisions, we're responsive, dependable, and committed to making the process as smooth and stress-free as possible.

-

Serving with Integrity and Excellence

We hold ourselves to the highest standards of ethical practice and professional excellence. Clients can count on us not just for our legal knowledge, skill and experience, but for honesty, transparency, and unwavering advocacy on their behalf.

-

Tailored Legal Guidance for Every Client

No two clients are the same. We take the time to truly understand each client’s concerns, goals, and values, crafting customized legal solutions that reflect what matters most to them.

A Will Can Provide for Control of Your Minor Children’s Inheritance (or Avoid It Altogether)

Many people are confused and believe that if they are survived by their spouse, their spouse would get everything. Well, in truth, that is not the case if there are children as well. If a person is survived by a spouse and children, their estate gets distributed between the spouse and the children. Frequently, this is not what someone would have wanted, particularly, if he or she is survived by minor children. A will allows you to direct everything to a spouse, whereupon the spouse can continue to provide for minor children. In the alternative, if you do want to leave an inheritance for your minor children, with or without a spouse, a will would allow you to name the person who would be in charge of the money until the child reaches an age that you designate.

Example: Mike passes away leaving his wife Amy and their four-year old twins. They own a house together, have joint checking and savings accounts, and Mike has a separate investment account valued at $500,000. The house and checking and savings accounts automatically become Amy’s. Easy! Because the investment account was only in Mike’s name, Amy is entitled to $50,000 plus half the balance, and the minor children are entitled to the rest. Minor children (under 18 years old) don’t get inherited money outright, so an adult would have to be in charge of the money until the children reach adulthood. Who chooses which adult? Without a will, the court decides! Ultimately, a court may decide that Amy is not responsible to manage the children’s inheritance and can appoint another guardian or custodian over the money (at a cost to the estate). Second, the children would get the money outright at age 18, and may not be responsible to manage their inheritance wisely at that young age. (Think about what you would have done with a large sum of money at age 18?)