Probate & Estate Administration Attorney in Long Island

The bottom line when it comes to probate and estate administration is to keep those you love from having to deal with unresolved estate issues while they are in the midst of grieving. The process by which an estate is reconciled, then distributed, is known as probate, if there is a will, and estate administration, if a person dies without a will. New York, like all states, has its own set of rules related to probate and estate administration. After the requirements are properly followed, your beneficiary can receive the assets you left for them.

New York probate and estate administration have the potential to be both lengthy as well as complicated. Prudent estate planning, however, can ensure the process occurs as quickly and painlessly as possible—you will both ensure your wishes are properly fulfilled and that your loved ones are not embroiled in problems when they are mourning your loss. An experienced New York probate lawyer can help you understand the probate process, while comprehensively answering all your questions. Esther Schwartz Zelmanovitz, PLLC, can assist you in designing an estate plan that will most closely fulfill all your wishes.

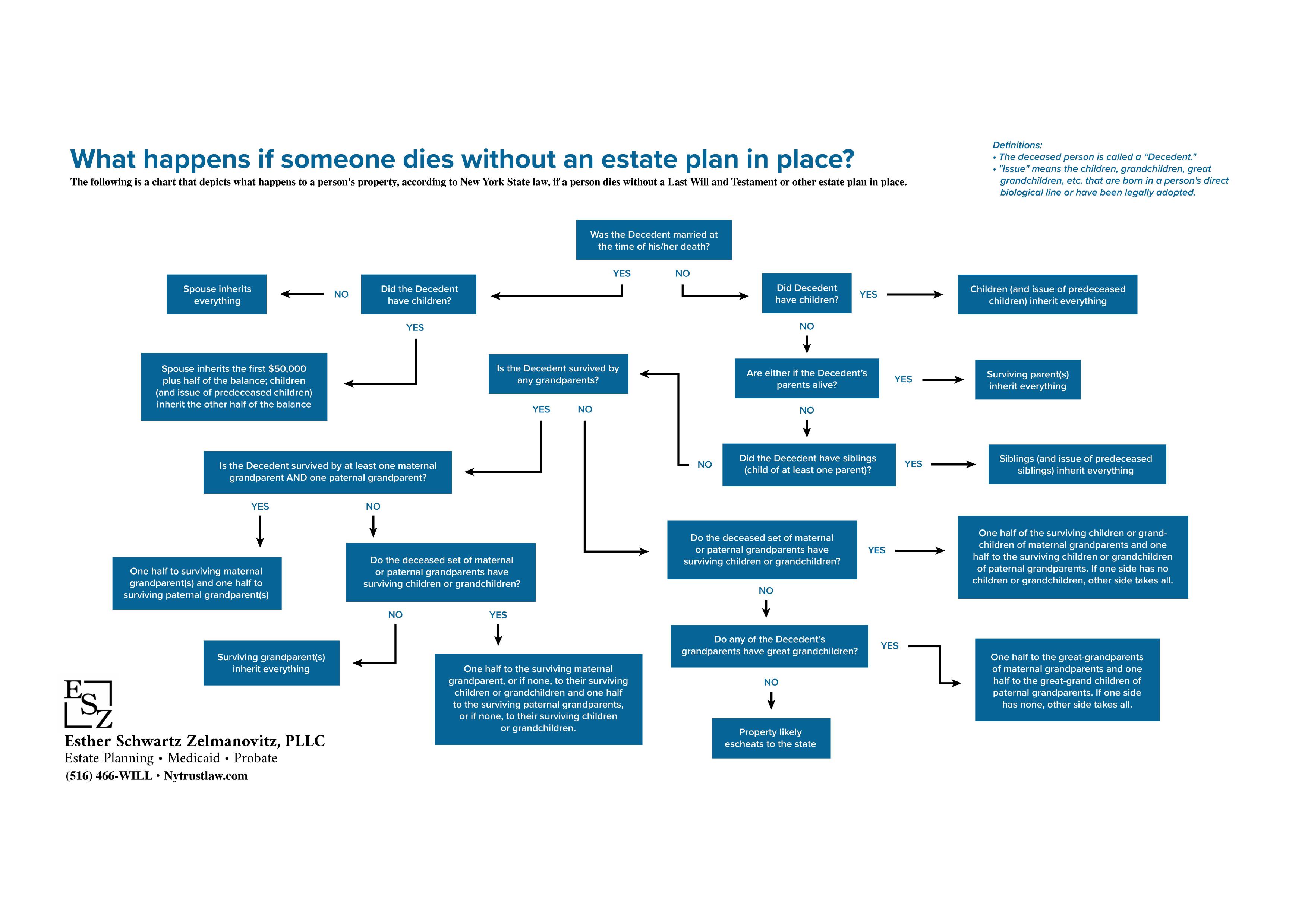

What Happens If Someone Dies Without an Estate Plan in Place?

CLICK TO DOWNLOAD THE FULL CHART.

Get reliable support from an estate administration lawyer in Long Island. Contact us online or call (516) 347-7356 for a free 15-minute phone consultation.

How Does Probate Begin in New York?

Following your death, if you have a will, your executor will initiate the legal process to wind up all your affairs and distribute your estate assets according to the provisions you have set forth. The executor you named in your will must submit a petition to the Surrogate’s Court, asking the court to recognize that the will is valid and for authority to administer your estate. This petition must include a copy of your death certificate, as well as your original will. The court will make a determination as to whether your will was properly executed, and if so, it will be “admitted to probate,” and the executor will be issued a document known as “Letters Testamentary.”

If you fail to have a will prepared, the state of New York will determine who will be in charge of winding up your affairs and distributing your assets, allocating the assets according to New York State Law. New York State law provides for who can petition the court to be appointed the “administrator” of your estate. The court may approve the appointment of your loved one but may require a bond be posted. The approved administrator will be issued “Letters of Administration.”

Once your executor or administrator has Letters Testamentary or Letters of Administration, he or she has the legal authority to handle your estate and must follow the distribution rules mandated by law, which may not necessarily result in your assets being distributed to those you would have chosen.

New York Probate Steps

The probate process in New York involves several steps to ensure an estate is handled correctly. Here’s how it works:

- File a Petition: The executor files a probate petition with the Surrogate’s Court in the county where the deceased resided. This requires the original will, death certificate, and a list of beneficiaries and interested parties.

- Validate the Will: The court reviews the will to confirm its validity and issues “Letters Testamentary,” giving the executor legal authority to manage the estate.

- Notify Creditors: Creditors are notified, and the executor consolidates estate assets to identify and address any debts or obligations.

- Pay Debts and Taxes: The executor pays outstanding debts, including taxes, using estate funds.

- Resolve Disputes: If disputes arise among beneficiaries or creditors, they are resolved through mediation or court intervention.

- Distribute Assets: Once debts are settled, remaining assets are distributed to beneficiaries as outlined in the will (or according to New York intestacy laws if no will exists).

A probate attorney in Long Island can guide you throughout these steps, ensuring legal compliance and reducing complexity during this challenging time.

Our Values, Your Peace of Mind The Principles That Define Our Firm

-

Compassionate, Relationship-Driven Service

We believe every client deserves to be treated with dignity, patience, and genuine care. Our firm fosters long-term relationships, guiding families with warmth and empathy through emotionally sensitive matters like elder care, estate planning, and loss.

-

Clear, Respectful Communication

We prioritize honest, prompt, and respectful communication. Whether answering questions or guiding you through complex decisions, we're responsive, dependable, and committed to making the process as smooth and stress-free as possible.

-

Serving with Integrity and Excellence

We hold ourselves to the highest standards of ethical practice and professional excellence. Clients can count on us not just for our legal knowledge, skill and experience, but for honesty, transparency, and unwavering advocacy on their behalf.

-

Tailored Legal Guidance for Every Client

No two clients are the same. We take the time to truly understand each client’s concerns, goals, and values, crafting customized legal solutions that reflect what matters most to them.